Do You Have To Pay Vat On Artwork . Vat is payable at differing rates on imported art in other countries. Imports of works of art, antiques and collectors’ items are taxed on a reduced value at importation, giving an effective vat rate of 5 per cent, see. Vat margin schemes tax the difference between what you paid for an item and what you sold it for, rather than the full selling price. Free zones are physically limited regions with favorable conditions for. All that is before you get involved with the sliding percentage scales and the fact that on works sold through the margin scheme, you may have to pay arr on the vat on art. Allowable business expenses for artists. Tax on importing art for exhibition and sale.

from legaldbol.com

Vat is payable at differing rates on imported art in other countries. Allowable business expenses for artists. Imports of works of art, antiques and collectors’ items are taxed on a reduced value at importation, giving an effective vat rate of 5 per cent, see. All that is before you get involved with the sliding percentage scales and the fact that on works sold through the margin scheme, you may have to pay arr on the vat on art. Vat margin schemes tax the difference between what you paid for an item and what you sold it for, rather than the full selling price. Tax on importing art for exhibition and sale. Free zones are physically limited regions with favorable conditions for.

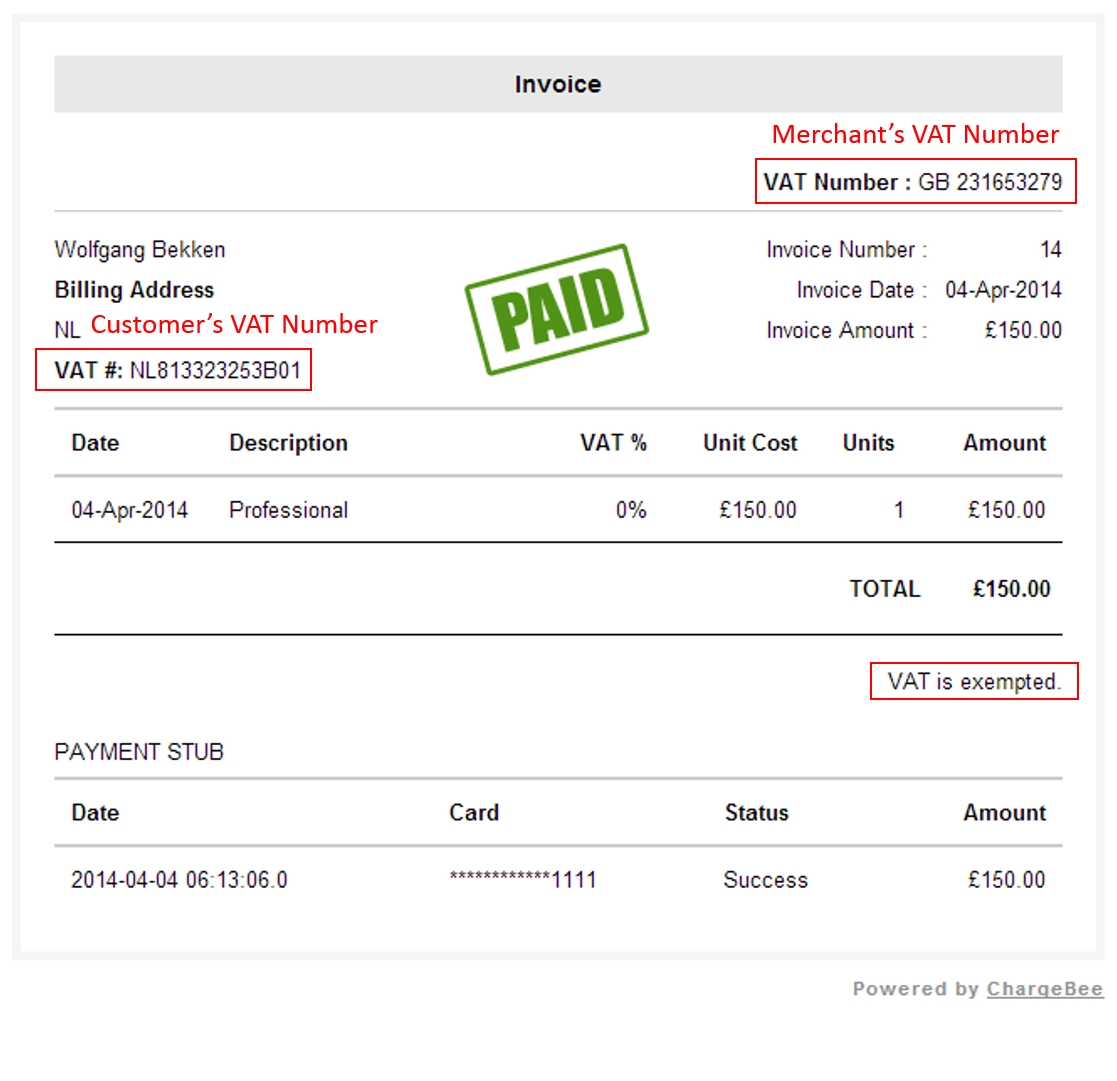

33 Format Vat Exempt Invoice Template in Word with Vat Exempt Invoice

Do You Have To Pay Vat On Artwork Allowable business expenses for artists. Free zones are physically limited regions with favorable conditions for. All that is before you get involved with the sliding percentage scales and the fact that on works sold through the margin scheme, you may have to pay arr on the vat on art. Vat margin schemes tax the difference between what you paid for an item and what you sold it for, rather than the full selling price. Vat is payable at differing rates on imported art in other countries. Tax on importing art for exhibition and sale. Allowable business expenses for artists. Imports of works of art, antiques and collectors’ items are taxed on a reduced value at importation, giving an effective vat rate of 5 per cent, see.

From www.artsy.net

Germany cuts VAT on artwork sales to 7. Artsy Do You Have To Pay Vat On Artwork Vat is payable at differing rates on imported art in other countries. All that is before you get involved with the sliding percentage scales and the fact that on works sold through the margin scheme, you may have to pay arr on the vat on art. Imports of works of art, antiques and collectors’ items are taxed on a reduced. Do You Have To Pay Vat On Artwork.

From francoisewdamara.pages.dev

When Do We Get Our Taxes 2024 Melly Sonnnie Do You Have To Pay Vat On Artwork Vat is payable at differing rates on imported art in other countries. Allowable business expenses for artists. Tax on importing art for exhibition and sale. Vat margin schemes tax the difference between what you paid for an item and what you sold it for, rather than the full selling price. Imports of works of art, antiques and collectors’ items are. Do You Have To Pay Vat On Artwork.

From sterlinxglobal.com

Do I Have To Pay VAT On Services From The EU? Accountants Liverpool Do You Have To Pay Vat On Artwork All that is before you get involved with the sliding percentage scales and the fact that on works sold through the margin scheme, you may have to pay arr on the vat on art. Vat is payable at differing rates on imported art in other countries. Vat margin schemes tax the difference between what you paid for an item and. Do You Have To Pay Vat On Artwork.

From twitter.com

Treckie on Twitter "I buy a package and I have to pay VAT on it to Do You Have To Pay Vat On Artwork All that is before you get involved with the sliding percentage scales and the fact that on works sold through the margin scheme, you may have to pay arr on the vat on art. Vat is payable at differing rates on imported art in other countries. Free zones are physically limited regions with favorable conditions for. Imports of works of. Do You Have To Pay Vat On Artwork.

From cruseburke.co.uk

All You Need to Know About When to Pay VAT CruseBurke Do You Have To Pay Vat On Artwork Imports of works of art, antiques and collectors’ items are taxed on a reduced value at importation, giving an effective vat rate of 5 per cent, see. Tax on importing art for exhibition and sale. Vat is payable at differing rates on imported art in other countries. Free zones are physically limited regions with favorable conditions for. Allowable business expenses. Do You Have To Pay Vat On Artwork.

From rumble.com

Do I have to pay VAT on silver? Do You Have To Pay Vat On Artwork All that is before you get involved with the sliding percentage scales and the fact that on works sold through the margin scheme, you may have to pay arr on the vat on art. Vat margin schemes tax the difference between what you paid for an item and what you sold it for, rather than the full selling price. Allowable. Do You Have To Pay Vat On Artwork.

From yourecommerceaccountant.co.uk

Do UK eBay Sellers Have To Pay VAT On Fees? Blog Do You Have To Pay Vat On Artwork Allowable business expenses for artists. Imports of works of art, antiques and collectors’ items are taxed on a reduced value at importation, giving an effective vat rate of 5 per cent, see. Vat is payable at differing rates on imported art in other countries. Vat margin schemes tax the difference between what you paid for an item and what you. Do You Have To Pay Vat On Artwork.

From sterlinxglobal.com

Do I Have To Pay VAT On Services From The EU? Accountants Liverpool Do You Have To Pay Vat On Artwork Allowable business expenses for artists. Vat is payable at differing rates on imported art in other countries. Tax on importing art for exhibition and sale. Vat margin schemes tax the difference between what you paid for an item and what you sold it for, rather than the full selling price. All that is before you get involved with the sliding. Do You Have To Pay Vat On Artwork.

From www.quaderno.io

The Ultimate Guide to EU VAT for Digital Taxes Do You Have To Pay Vat On Artwork Vat is payable at differing rates on imported art in other countries. Tax on importing art for exhibition and sale. Allowable business expenses for artists. Imports of works of art, antiques and collectors’ items are taxed on a reduced value at importation, giving an effective vat rate of 5 per cent, see. All that is before you get involved with. Do You Have To Pay Vat On Artwork.

From legaldbol.com

33 Format Vat Exempt Invoice Template in Word with Vat Exempt Invoice Do You Have To Pay Vat On Artwork Free zones are physically limited regions with favorable conditions for. All that is before you get involved with the sliding percentage scales and the fact that on works sold through the margin scheme, you may have to pay arr on the vat on art. Allowable business expenses for artists. Imports of works of art, antiques and collectors’ items are taxed. Do You Have To Pay Vat On Artwork.

From www.marketyourcreativity.com

I'm American Do I have to pay VAT to the EU? Marketing Creativity Do You Have To Pay Vat On Artwork Vat margin schemes tax the difference between what you paid for an item and what you sold it for, rather than the full selling price. Allowable business expenses for artists. Tax on importing art for exhibition and sale. Vat is payable at differing rates on imported art in other countries. Imports of works of art, antiques and collectors’ items are. Do You Have To Pay Vat On Artwork.

From www.marketyourcreativity.com

I'm American Do I have to pay VAT to the EU? Marketing Creativity Do You Have To Pay Vat On Artwork Imports of works of art, antiques and collectors’ items are taxed on a reduced value at importation, giving an effective vat rate of 5 per cent, see. Allowable business expenses for artists. Free zones are physically limited regions with favorable conditions for. Vat is payable at differing rates on imported art in other countries. Vat margin schemes tax the difference. Do You Have To Pay Vat On Artwork.

From www.slideserve.com

PPT Do eBay Sellers have to Pay VAT on Fees PowerPoint Presentation Do You Have To Pay Vat On Artwork All that is before you get involved with the sliding percentage scales and the fact that on works sold through the margin scheme, you may have to pay arr on the vat on art. Imports of works of art, antiques and collectors’ items are taxed on a reduced value at importation, giving an effective vat rate of 5 per cent,. Do You Have To Pay Vat On Artwork.

From smallbusiness.co.uk

Do I have to charge VAT? Small Business UK Do You Have To Pay Vat On Artwork Free zones are physically limited regions with favorable conditions for. Allowable business expenses for artists. Vat is payable at differing rates on imported art in other countries. Tax on importing art for exhibition and sale. All that is before you get involved with the sliding percentage scales and the fact that on works sold through the margin scheme, you may. Do You Have To Pay Vat On Artwork.

From www.tide.co

A guide to domestic VAT reverse charges Tide Business Do You Have To Pay Vat On Artwork Vat margin schemes tax the difference between what you paid for an item and what you sold it for, rather than the full selling price. Vat is payable at differing rates on imported art in other countries. Allowable business expenses for artists. Imports of works of art, antiques and collectors’ items are taxed on a reduced value at importation, giving. Do You Have To Pay Vat On Artwork.

From www.youtube.com

Do charities have to pay VAT? YouTube Do You Have To Pay Vat On Artwork Free zones are physically limited regions with favorable conditions for. Allowable business expenses for artists. All that is before you get involved with the sliding percentage scales and the fact that on works sold through the margin scheme, you may have to pay arr on the vat on art. Vat margin schemes tax the difference between what you paid for. Do You Have To Pay Vat On Artwork.

From www.ag.construction

Do you pay VAT on extensions? Do You Have To Pay Vat On Artwork Allowable business expenses for artists. Vat margin schemes tax the difference between what you paid for an item and what you sold it for, rather than the full selling price. Tax on importing art for exhibition and sale. Imports of works of art, antiques and collectors’ items are taxed on a reduced value at importation, giving an effective vat rate. Do You Have To Pay Vat On Artwork.

From www.youtube.com

Do US businesses have to pay VAT in the EU? YouTube Do You Have To Pay Vat On Artwork Allowable business expenses for artists. All that is before you get involved with the sliding percentage scales and the fact that on works sold through the margin scheme, you may have to pay arr on the vat on art. Vat margin schemes tax the difference between what you paid for an item and what you sold it for, rather than. Do You Have To Pay Vat On Artwork.